Download Irs Schedule C Printable created for performance and performance. Perfect for students, specialists, and hectic households.

From basic daily strategies to in-depth weekly layouts, our templates assist you stay on top of your priorities with ease.

Irs Schedule C Printable

Irs Schedule C Printable

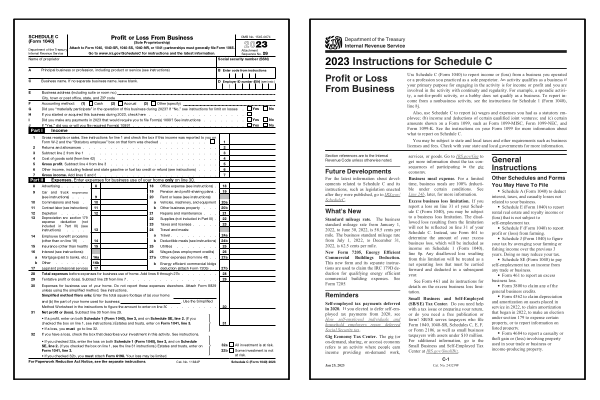

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary The 2023 Form 1040 Schedule C is a supplemental form used in conjunction with the Form 1040 to report the profit or loss from a sole proprietorship business. This schedule is used by self.

Federal 1040 Schedule C Profit Or Loss From Business Sole

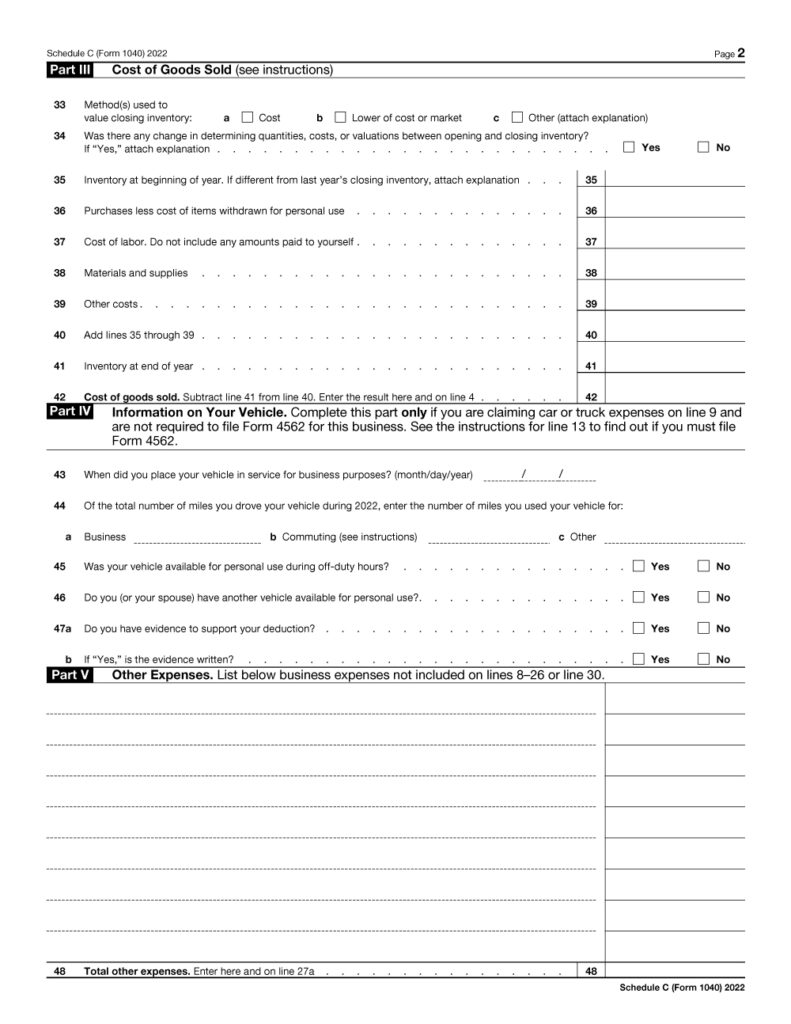

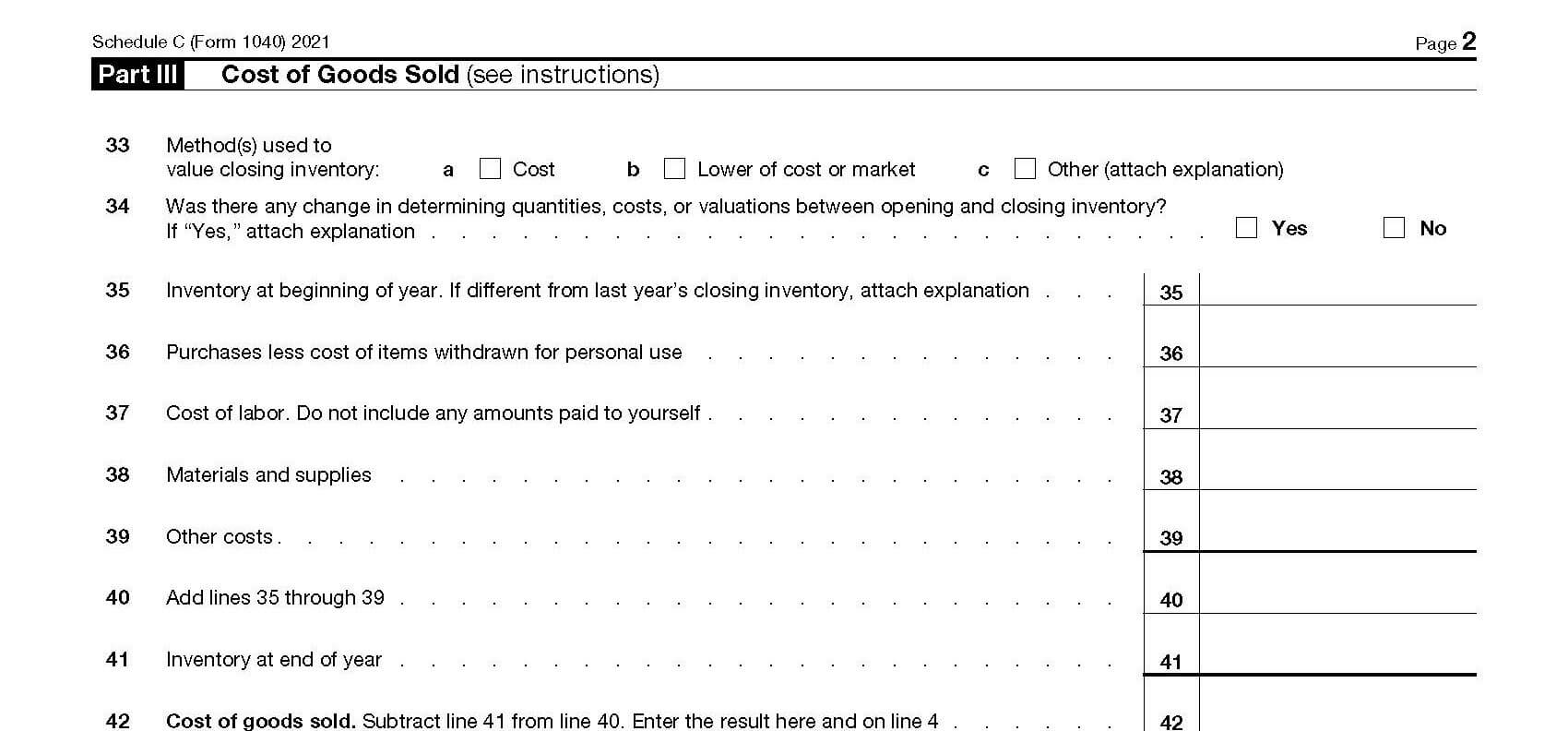

2024 Schedule C Form and Instructions (Form 1040)

Irs Schedule C Printable · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and

Definition Schedule C is the IRS form small business owners use to calculate the profit or loss from their business That amount from Schedule C is then entered on the owner s What Is Schedule C of Form 1040? · IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C.

2023 1040 Schedule C Profit Or Loss From Business E File

What is an IRS Schedule C Form?

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if How to Complete IRS Schedule C

Download or print the 2023 Federal 1040 Schedule C Profit or Loss from Business Sole Proprietorship for FREE from the Federal Internal Revenue Service How to Fill out Schedule C Form 1040 – Sole Proprietorship Taxes - YouTube All about Schedule C from Form 1040

How to fill out a Schedule C tax form for 2023 | Everlance

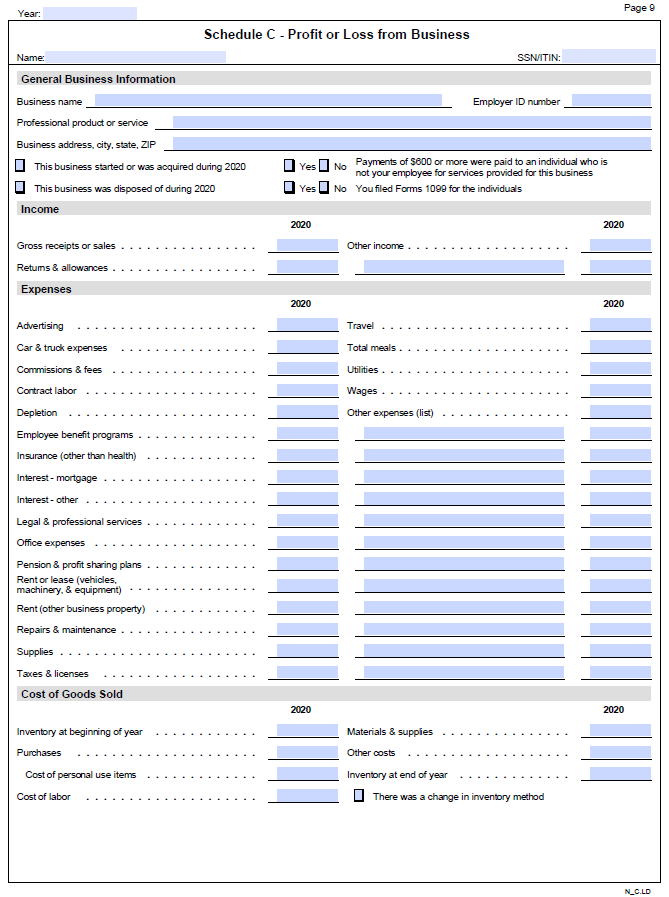

Schedule C Small Business Organizer - Daniel Ahart Tax Service®

Schedule C (Form 1040) 2023 Instructions

What is Schedule C (Profit & Loss)? - Uber, Lyft, Taxi Drivers, Independent Contractor | Tax/Accounting Services in California

2023 Instructions for Schedule C

What is the IRS Schedule C form & who has to file it?

Schedule C Expenses Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Complete IRS Schedule C

How to Fill Out Your Schedule C Perfectly (With Examples!)

Tax IRS 1040 Schedule C Template | LiveFlow