Download Are Charitable Contributions A Business Expense developed for performance and effectiveness. Perfect for trainees, specialists, and hectic families.

From easy daily strategies to detailed weekly layouts, our templates help you remain on top of your priorities with ease.

Are Charitable Contributions A Business Expense

Are Charitable Contributions A Business Expense

33 rows ESPN has the full 2024 25 Syracuse Orange Regular Season NCAAM schedule · Eight Syracuse league games will be televised by the ACC Network, including.

Printable 2024 25 Syracuse Orange Basketball Schedule TV

Noncash Charitable Contributions Fair Market Value Guide 2019

Are Charitable Contributions A Business Expense · The official 2021-22 Men's Basketball schedule for Atlantic Coast Conference. 16 rows 2024 25 Syracuse Men s Basketball Schedule To download an ics

The official 2022 23 Men s Basketball schedule for Atlantic Coast Conference Donation Tracker Template Syracuse, N.Y. (JMA Wireless Dome) W 101-73. Oct 30 (Wed) 7 PM. Home. Slippery Rock.

Complete Men s Basketball Schedule Announced Syracuse

What Businesses Should Know About Charitable Contributions Provident

ESPN has the full 2023 24 Syracuse Orange Regular Season NCAAM schedule Includes Statement Of Financial Position Non Profit

The printable 2024 25 Syracuse Orange basketball schedule with TV Startup School Lesson 1 Your Business Money Is Your Business Money Charitable Contributions Deduction Liberalized For 2021 Corporate Tax

Can You Claim Clothing As A Business Expense Crunch Accounting Services

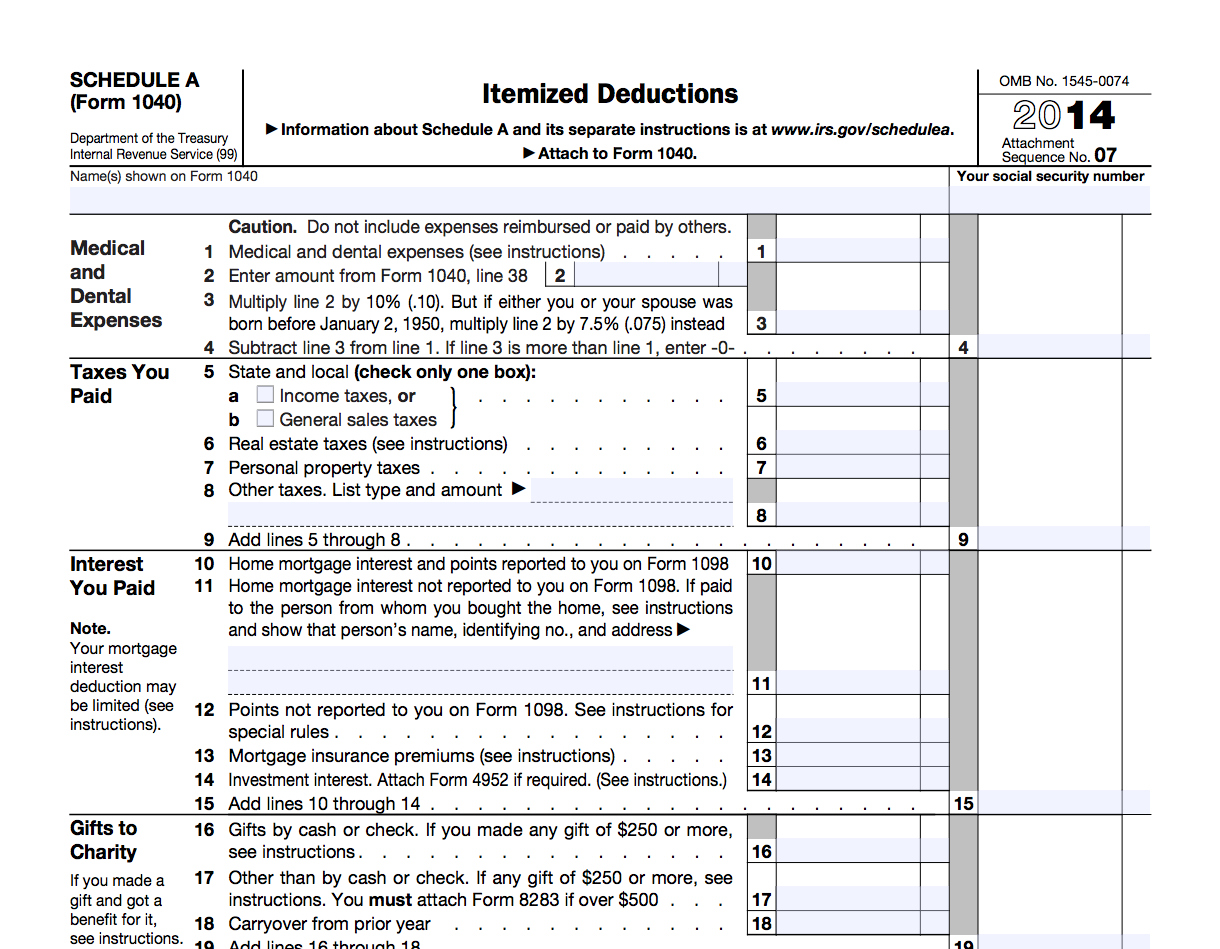

General Sales Tax Deduction For 2022

Understanding Business Expenses And Which Are Tax Deductible Reliable

Deducting Business Expenses

Statement Of Activities Reading A Nonprofit Income Statement The

Financial Contributions To Home Working What Should Employers Clip

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Statement Of Financial Position Non Profit

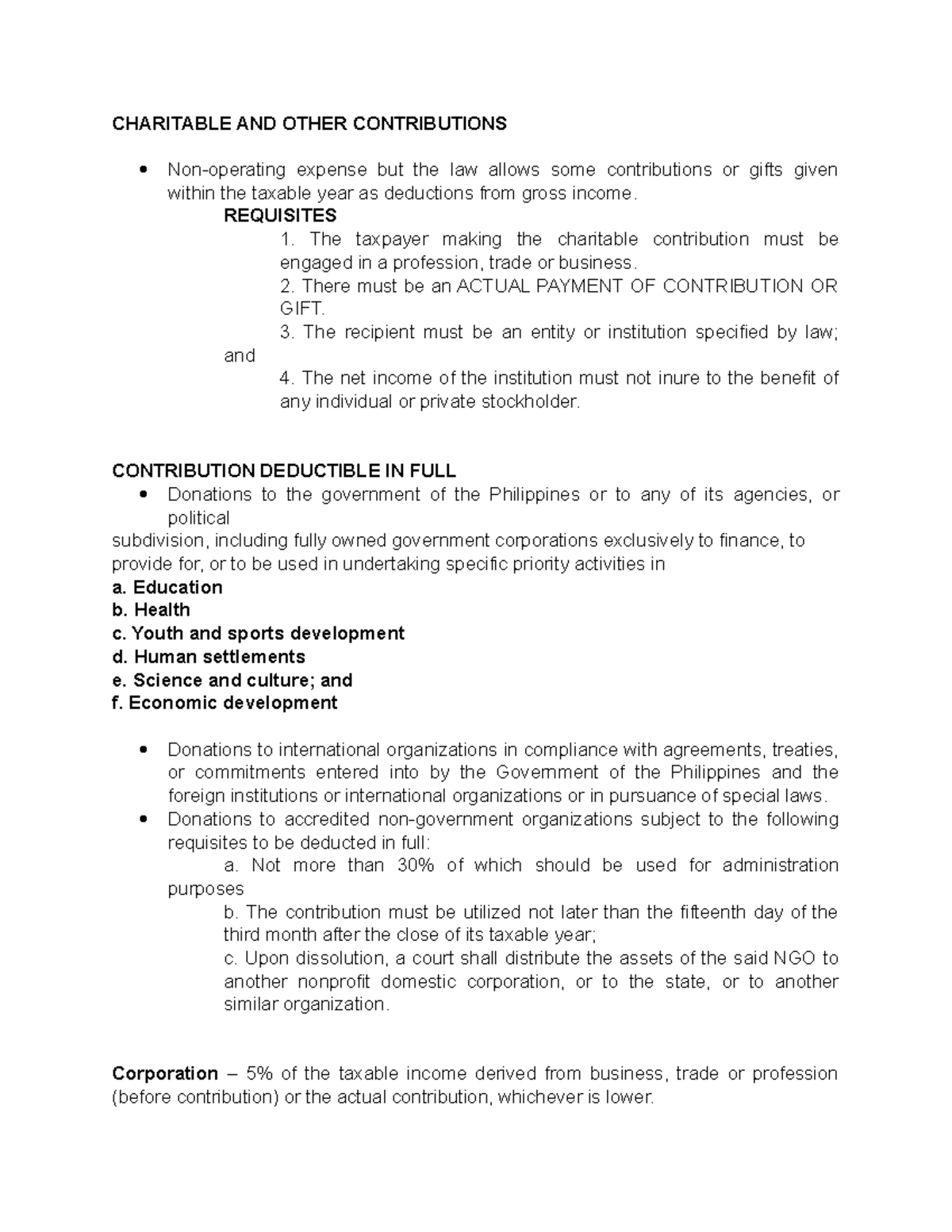

Charitable AND Other Contributions CHARITABLE AND OTHER CONTRIBUTIONS

Charitable Contributions Using RMD s Financial Matters