Download How Much Does An Employer Pay In Taxes For An Employee In California designed for productivity and performance. Perfect for trainees, professionals, and busy families.

From easy daily strategies to comprehensive weekly layouts, our templates help you remain on top of your concerns with ease.

How Much Does An Employer Pay In Taxes For An Employee In California

How Much Does An Employer Pay In Taxes For An Employee In California

[desc_5]

How Much Does An Employer Pay In Payroll Taxes Tax Rate

How Much Does An Employer Pay In Taxes For An Employee In California[desc_6]

Solved Or The Class Employee Example Provided In Tutorial Chegg [desc_3]

Employers Vs Employees PDF

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

Payroll Tax What It Is How To Calculate It NetSuite Solved The Employees Of Pelter Company Earn Wages Of 12 000 Chegg

How Much Does An Employer Pay In Payroll Taxes Tax Rate

How Much Do Employers Pay For Health Insurance PeopleKeep

California Payroll Tax Unemployment State Disability More

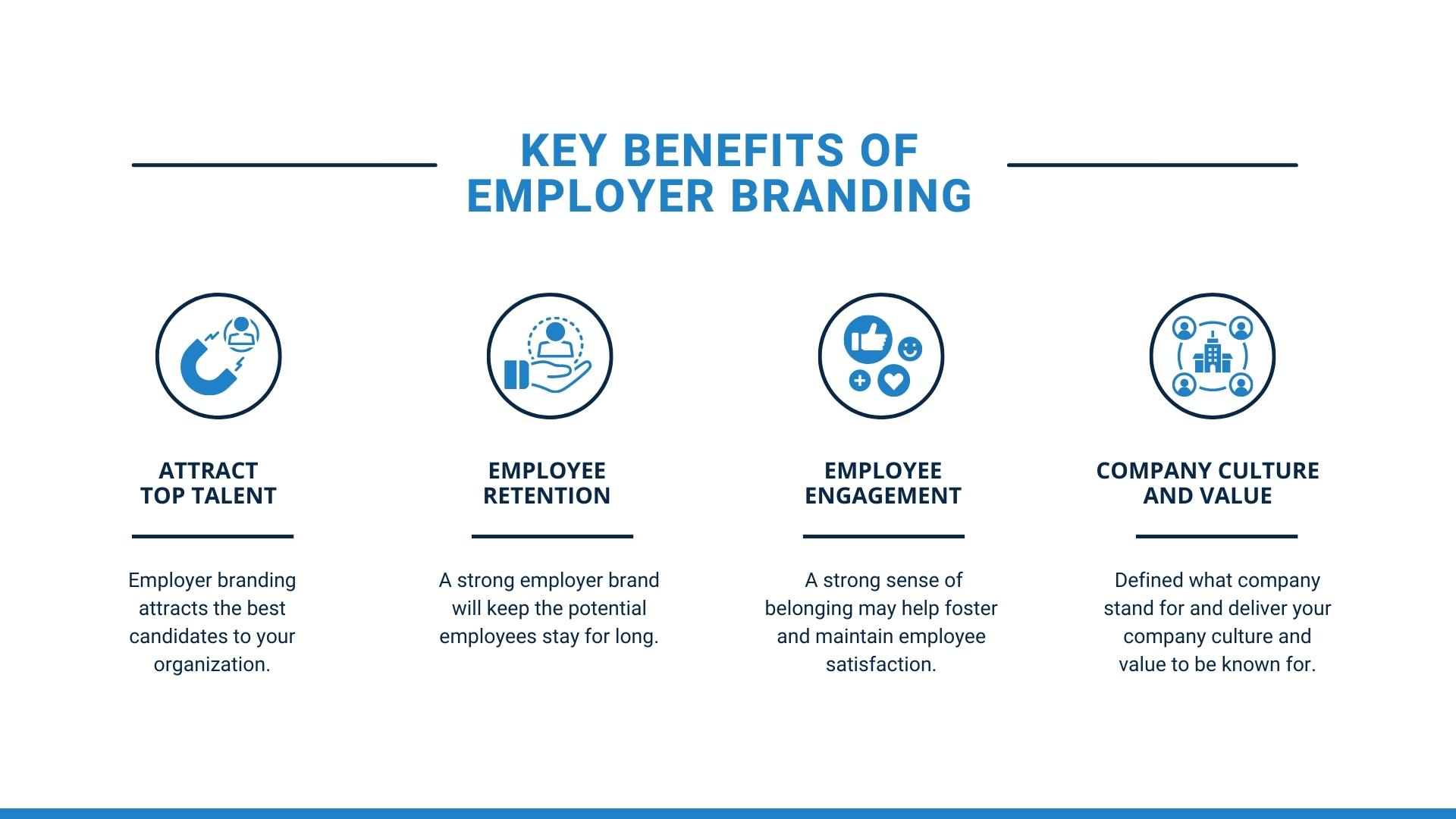

Employer Branding Service Criterion Asia Recruitment

How Long Does The IRS Give You To Pay What You Owe Leia Aqui How Long

How Do I Pay Employer Payroll Taxes Employer Payroll Taxes

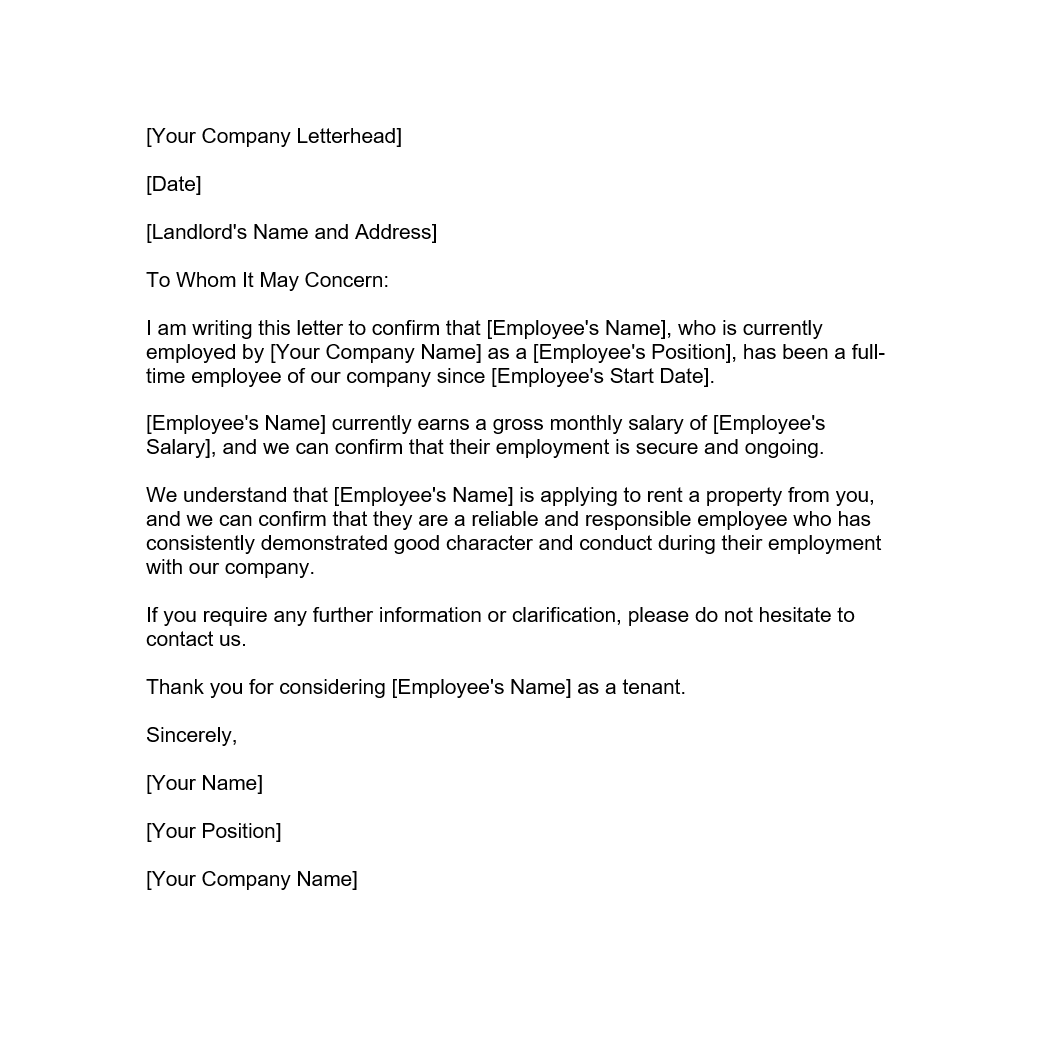

Employer Reference Letter For Rental Forms Docs 2023

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

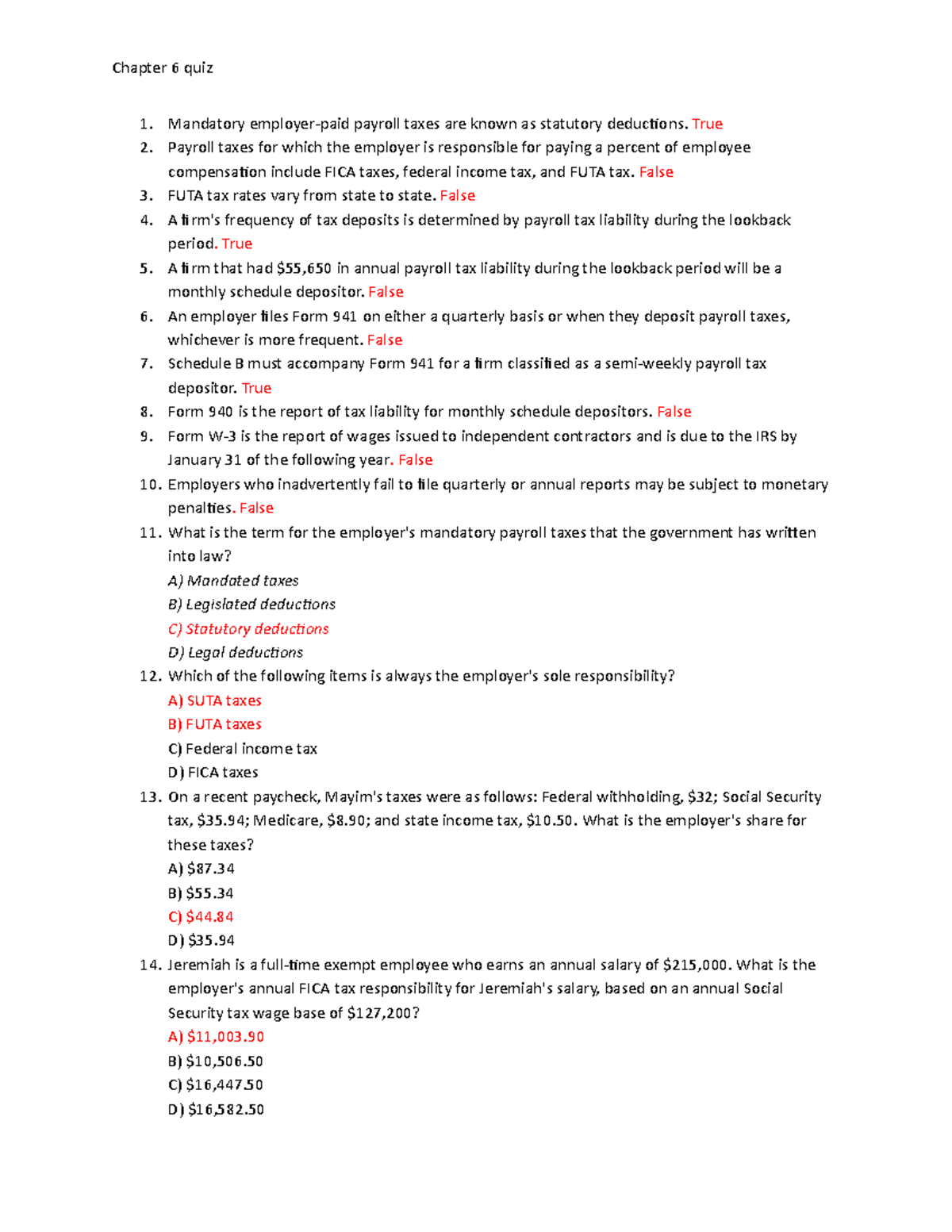

Chapter 6 Quiz Employer Payroll Taxes And Labor Planning Mandatory

How Much Money Does The Government Collect Per Person