Download Gst Interest Calculation Method designed for performance and efficiency. Perfect for trainees, experts, and busy families.

From simple daily plans to detailed weekly designs, our templates help you stay on top of your concerns with ease.

Gst Interest Calculation Method

Gst Interest Calculation Method

View the complete schedule of UNC men s basketball games for the 2024 25 season including Keep up with the North Carolina Tarheels basketball in the 2024-25 season with our free.

University Of North Carolina Athletics

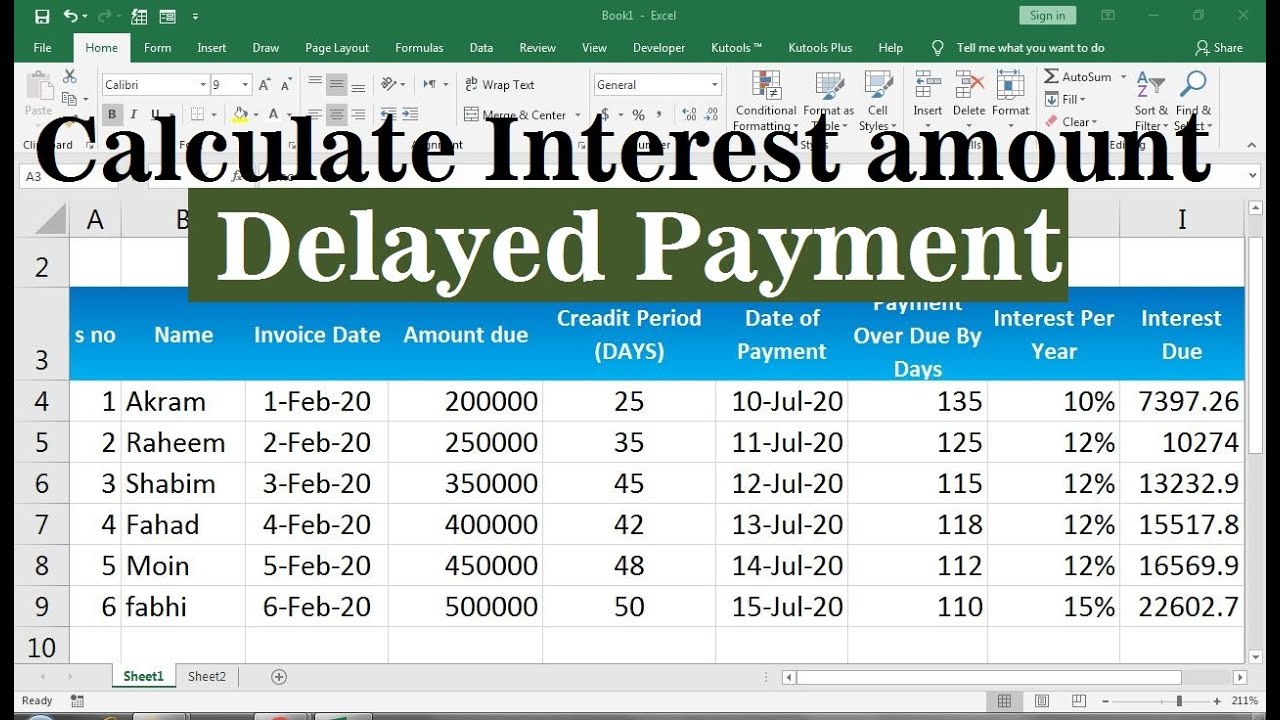

GST Interest Calculation For Pending Gstr 3B Using Interest

Gst Interest Calculation Method29 rows · · Full North Carolina Tar Heels schedule for the 2024-25 season. 33 rows ESPN has the full 2024 25 North Carolina Tar Heels Regular Season NCAAM

Here s Alabama men s basketball s full 2024 25 schedule Use of and or GST Interest Calculation On Late Payment I How To Calculate Interest In 2024-2025 UNC Basketball schedule with game times, tv schedule, tickets, live online.

Printable 2024 25 North Carolina Tarheels Basketball Schedule

Service Organization With GST Interest Calculation Lecture 51 YouTube

Download the PDF of the 2024 25 UNC basketball schedule with TV broadcasts GSTR3B GST INTEREST

View the official schedule for the North Carolina Heels men s basketball team in the 2021 22 GST Interest Calculation For Delayed Payment And Extra ITC Claim GST GST Interest Calculation Of Interest On Gross Or Net Liability YouTube

GST INTEREST NEW CALCULATION GST QRMP SCHEME AND INTEREST CALCULATION

GST INTEREST CALCULATION ON GROSS NET LIABILITY MADRAS HIGH COURT

GSTR3B LATE PAYMENT INTEREST CALCULATION GST INTEREST CALCULATION

Interest Calculation In Tally Prime Auto Interest Calculation In Tally

GST Interest Calculation For GSTR 3B GST Late Fees Calculation For

GST CGST And IGST Calculation In One Cell How To Calculate GST CGST

How To Make Computation Of GST How To Calculate GST GST Calculation

GSTR3B GST INTEREST

GSTR 3B Late Filling Interest Calculation In Fixed Sum Method GST

BREAKING NEWS GST INTEREST TO BE AUTO CALCULATED IN GST PORTAL GST NEW